Shorooq Partners announces the first close of its $100 million second private credit fund. The Fund was launched in collaboration with IMM Investment Global (IMMG), an arm of IMM Investment, which is a leading private equity and venture capital firm in Korea with over $6bn in assets under management, who joins the fund as a minority partner. The partnership continues the bond forged between the two firms through their first credit fund launched three years ago.

Fully deployed now, this first credit fund saw multiple notable deals that reshaped the region’s fundraising landscape. Notable investments include Pure Harvest, a smart farm producing fresh crops in the middle of deserts, and Tamara, Kingdom of Saudi Arabia’s first Buy Now, Pay Later (BNPL) platform and fintech unicorn. These ventures have emerged as leaders in their respective sectors, underscoring the impact of Shorooq Partners’ and IMMG’s credit facility in fueling innovation and driving economic growth.

Shane Shin, Founding Partner at Shorooq Partners, added, “It’s imperative to recognize the nuanced advantages of non-dilutive financing, particularly within the MENA region where debt financing among founders is steadily gaining momentum. Amidst this landscape, we champion the pivotal role of non-dilutive funding, offering a sophisticated alternative to traditional equity-based approaches. For mature companies and founders who have navigated the complexities of fundraising and attained the milestone of a completed Series A round, our tailored solutions provide a compelling avenue for sustained growth. With a focus on recurring revenue, robust cash flow positions, and tangible assets, our targeted approach ensures alignment with our strategic and institutional investors. As the MENA region continues its ascent as a hub of entrepreneurial dynamism, discerning founders recognize the imperative of integrating non-dilutive financing into their fundraising calculus, positioning themselves not just for growth, but for enduring success amidst evolving market dynamics.”

The private credit market in the MENA region has witnessed remarkable growth, driven by the burgeoning tech ecosystem and increasing demand for alternative financing solutions. According to recent data, the MENA private credit market grew at a compound annual growth rate (CAGR) of 12% over the past five years, signaling significant opportunities for expansion and investment.

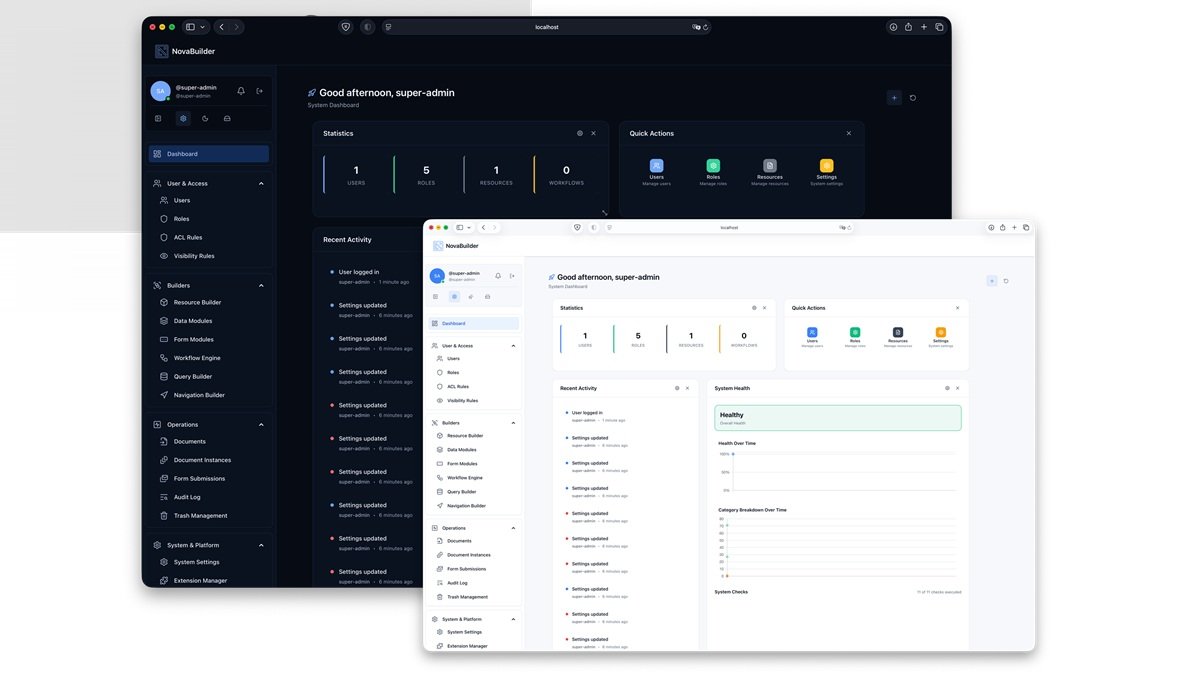

Nathan Kwon, Principal at Shorooq Partners, remarked, “Last year we saw over $400mm of deal flow after screening for companies that did not qualify for credit. This surge in deaflow underscores a robust interest towards the fund’s mission to foster scalable growth in the companies we invest in. With an average ticket size of $10mm, we are looking for companies in manufacturing, industrials, financing and software services seeking to secure capital for the next stage in their journey.”

Shorooq Partners and IMMG recognize the pivotal role of credit in addressing capital market gaps and providing non-dilutive, scalable capital to innovative ventures. With its second credit fund, the firm is poised to deepen its impact and support the next generation of disruptors, amplifying their potential for success and societal impact.

“Our vision extends beyond financial returns; we are committed to fostering a vibrant and diversified tech ecosystem that drives efficient and sustainable growth,” emphasized Kwon. “As we embark on this new chapter, we invite founders and companies across the region to reach out to us as they shape the future of innovation and entrepreneurship.”