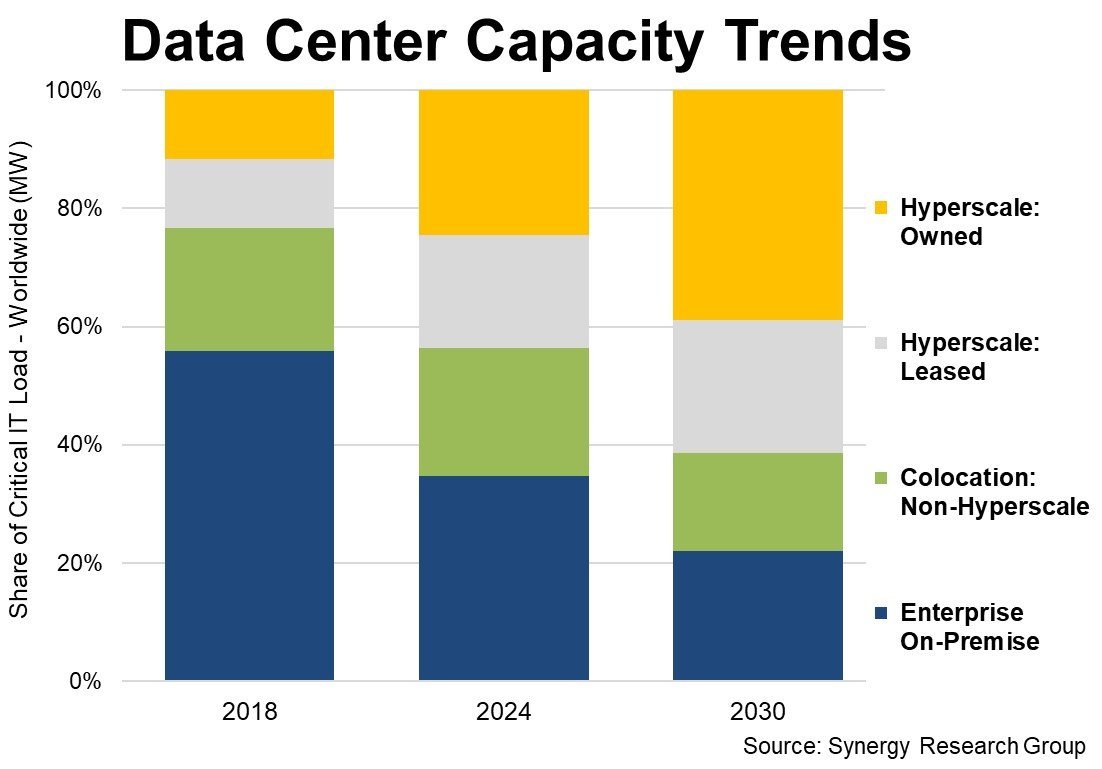

The number of large data centers operated by hyperscale companies reached 1,189 at the end of the first quarter, and new data from Synergy Research Group shows that they now account for 44% of the worldwide capacity of all data centers. Over half of that hyperscale capacity is now in own-built, owned data centers with the balance being in leased facilities. With non-hyperscale colocation capacity accounting for another 22% of capacity, that leaves on-premise data centers with just 34% of the total.

This is in stark contrast to six years ago, when almost 56% of data center capacity was in on-premise facilities. Looking ahead to 2030, hyperscale operators will account for 61% of all capacity, while on-premise will drop to just 22%. Over that period, the total capacity of all data centers will continue to rise rapidly, driven primarily by hyperscale capacity growing threefold over the next six years.

While colocation share of total capacity will slowly decrease, colocation capacity will continue to increase each year at near double-digit rates. After a sustained period of essentially no growth, on-premise data center capacity is receiving something of a boost thanks to GenAI applications and GPU infrastructure. Nonetheless, on-premise share of the total will drop by around two percentage points per year over the forecast period.

The Synergy data is based on a combination of several detailed quarterly tracking research services, allowing for a comprehensive analysis of data center capacity, segmented by region, country, and metropolitan area. The hyperscale research is based on in-depth analysis of the data center footprint and operations of the world’s major cloud and internet service firms, including the largest operators in SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming. The colocation research is based on Synergy’s in-depth tracking of the colocation market, including quarterly data on over 320 individual companies. The enterprise on-premise analysis is based on Synergy’s tracking of the data center hardware market.

“Cloud and other key digital services have been the prime drivers behind data center capacity expansion, and the dramatic rise of AI technology and applications is now providing an added impetus,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “However, the mix of data center capacity is quite different region by region, an example being that hyperscale owned data center capacity is much more prevalent in the US than in either the EMEA or APAC regions. Overall though, the trends are all heading in the same direction. All regions will see double-digit annual growth rates in overall data center capacity over the forecast period, and all regions will see the hyperscale owned portion of that capacity growing by at least 20% per year.”